Shinhan Investment Corp.

As the leader of the financial investment industry, Shinhan Investment Corp. places top priority on its partnership role in successful investments in order to create values that our customers want and to design a better future for our customers. We strive to provide a better tomorrow for our customers by offering abundant products and services via Shinhan Financial Group’s extensive network, and evaluating our employees based on return on customer. We will do our best to become a partner in ‘making a happier tomorrow ’ by always thinking about our customer’s success.

Dae Seok Kang CEO of Shinhan Investment Corp.

Company Introduction

Shinhan Investment Corp. was established in 2002 through the merger of Shinhan Securities and Goodmorning Securities. The company converted from a securities firm to a financial investment company with the introduction of the Financial Services Act in 2009, acquiring the current company name. Based on a strong corporate governance structure and financial stability, we have emerged as the leader in the financial investment industry by integrating advanced management techniques. We provide differentiated asset management services based on the industry’s leading sales capabilities in global equity and derivative products, in-depth research skills, stable product management strategies and advanced management techniques.

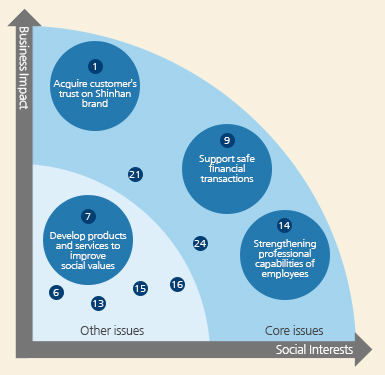

Material Issue Map

Major Issues Reported in 2012

Shinhan Investment Corp. conducted material issue evaluation to produce reports on areas of interest for various internal and external stakeholders.

As material issue evaluation results, we selected 5 Core issues, including ‘acquiring customer’s trust on Shinhan brand’, and 5 other issues, including ‘developing products and services to increase social values’. The 2012 CSR Report covered various issues, including ‘acquiring customer’s trust on Shinhan brand’, ‘supporting safe financial transactions’ and ‘strengthening the professional capabilities of employee’s as Core issues, while ‘developing 21 products and services to increase social values’ was selected as other issues.

Distribution of Economic Value

(Unit: KRW 1 billion )| Employees | Employee salaries/ welfare benefits | 222.5 |

|---|---|---|

| Shareholders, investors | Dividends | 20 |

| Local communities | Social contribution investments | 2.1 |

| Government | Corporate tax expenses | 15.2 |

| Partner companies | Purchase and services | 14.5 |

| Others | Other general administrative expenses | 112.7 |